Overview

These monthly statistics on the amount of, and interest rates on, borrowing and deposits by households and businesses are used by the Bank’s policy committees to understand economic trends and developments in the UK banking system.Key points:

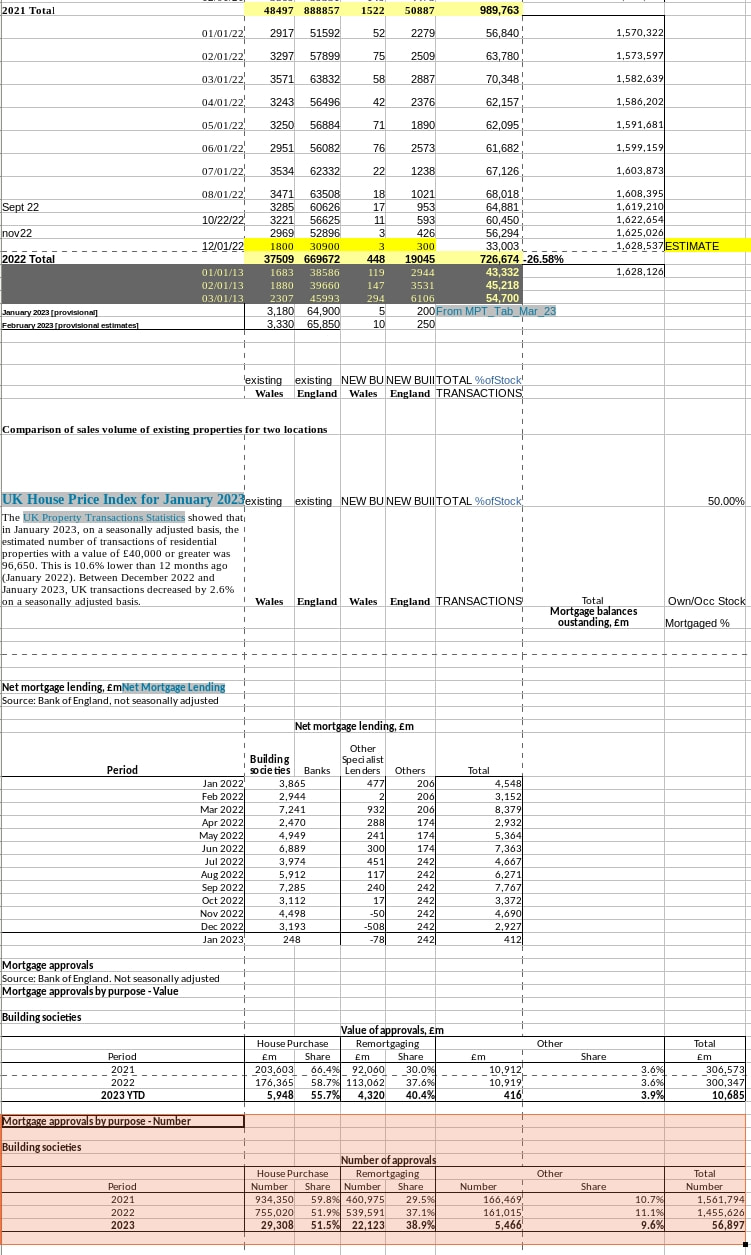

- Net mortgage lending to individuals decreased from £2.0 billion to £0.7 billion in February. Looking at the period prior to the onset of Covid-19 in March 2020, this is the lowest level of net borrowing since April 2016 (also £0.7 billion).

- Net mortgage approvals for house purchases increased to 43,500 in February, from 39,600 in January. This marked the first monthly increase since August 2022.

- The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 36 basis points, to 4.24% in February.

- Consumers borrowed an additional £1.4 billion in consumer credit in February, on net, compared with £1.7 billion borrowed during January. This was split between £0.6 billion of borrowing on credit cards and £0.8 billion of borrowing through other forms of consumer credit.

- Households deposited an additional £1.6 billion with banks and building societies in February. Within this, net flow into time deposits remained strong at £6.8 billion, but this was largely offset by net withdrawals from sight deposits.

- Non-financial companies (PNFCs) repaid £1.9 billion in market finance, while non-financial businesses (PNFCs and public corporations) repaid £4.5 billion of bank loans in February.

- The net flow of sterling money (known as M4ex) witnessed a significant fall to -£6.9 billion in February, from £38.6 billion in January. This was primarily driven by non-intermediate other financial corporations (NIOFCs), with net flows decreasing to -£6.6 billion (from £33.0 billion in January). Net lending to the private sector (known as M4Lex) also decreased, to -£21.5 billion from -£7.3 billion over the same period.

Lending to individuals

Mortgage lending (M&C Tables D and E):

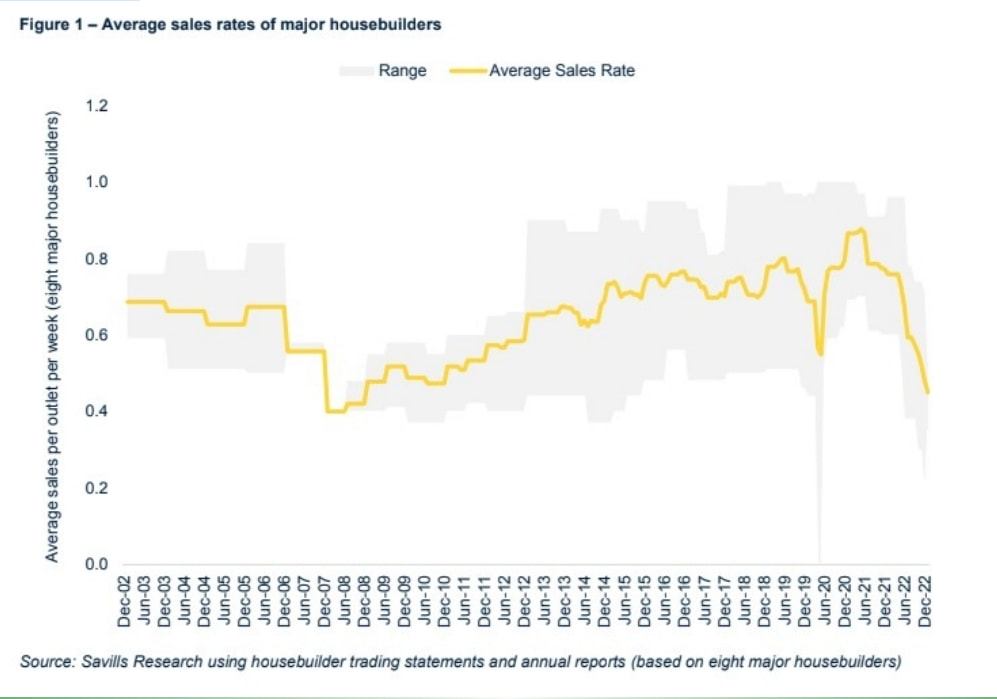

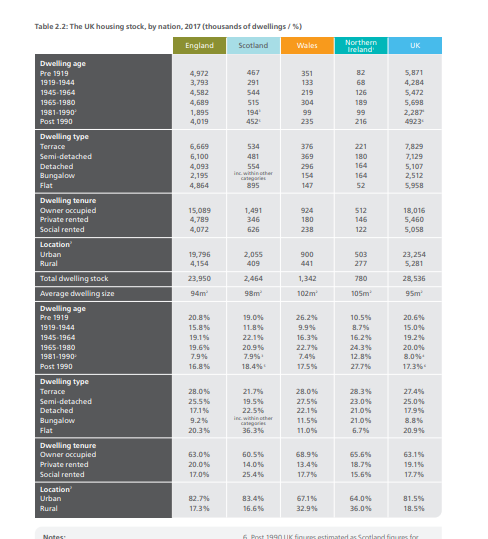

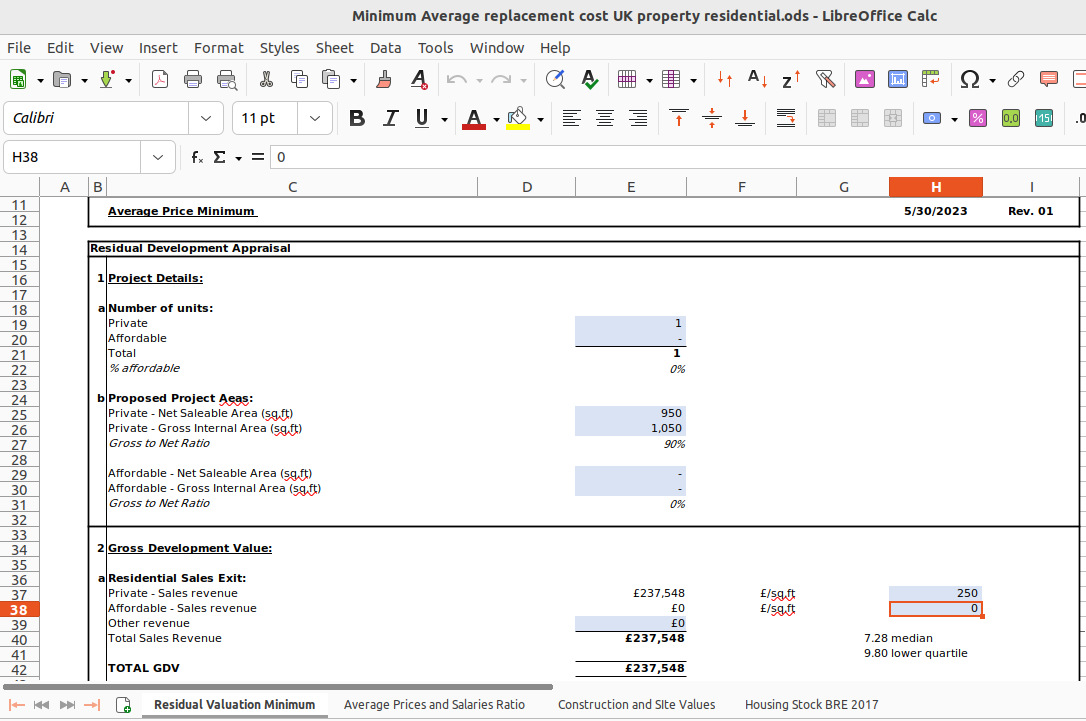

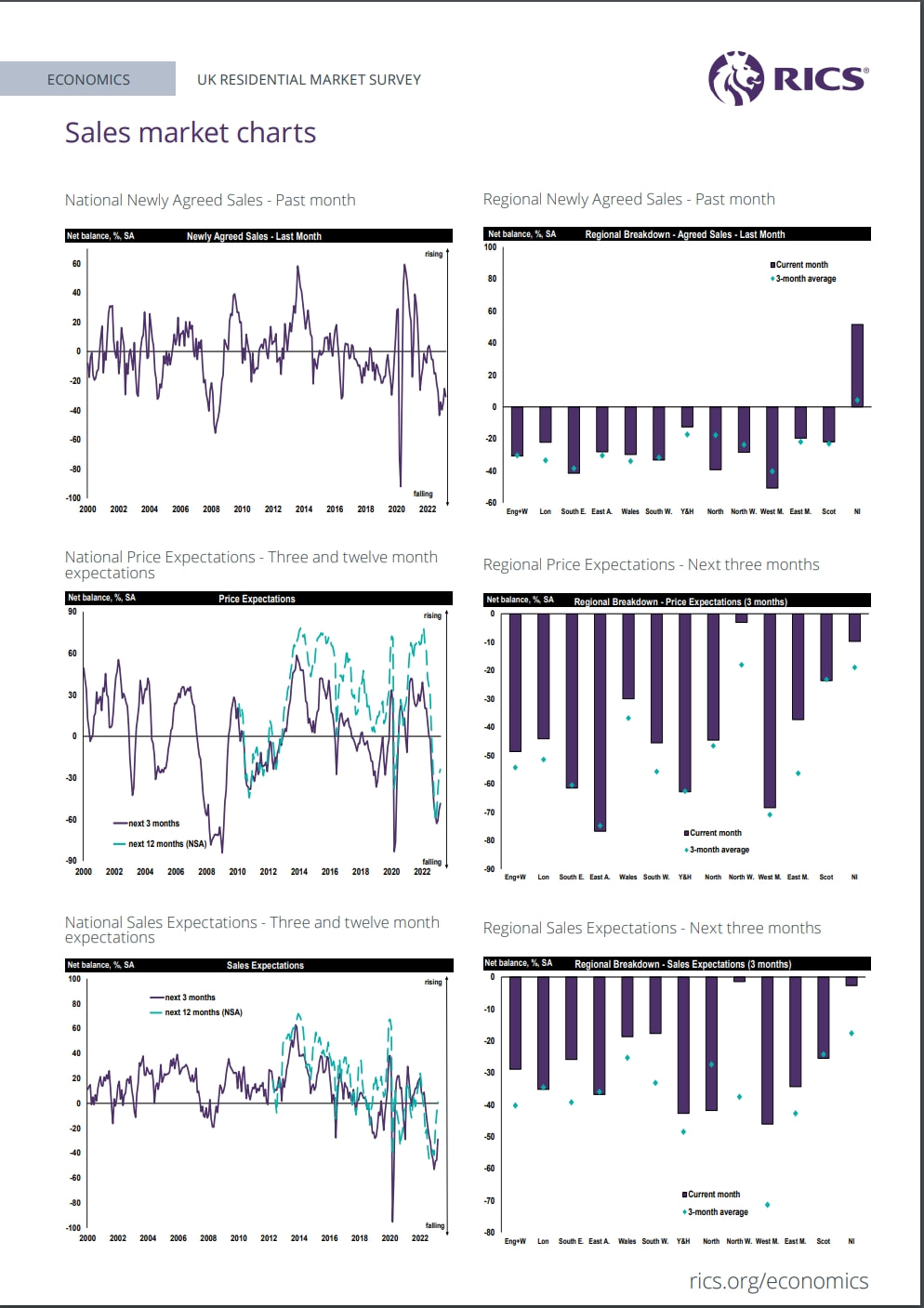

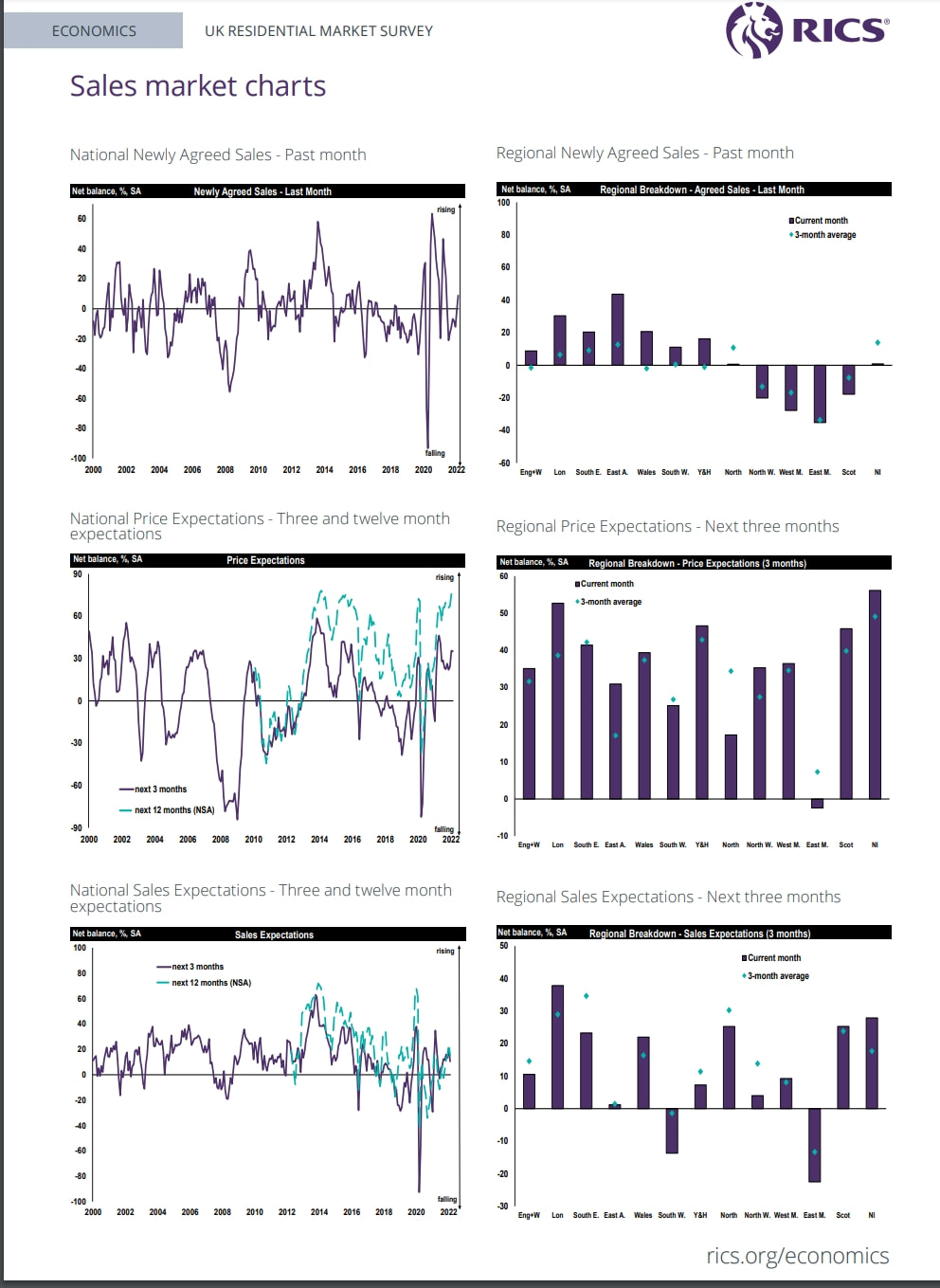

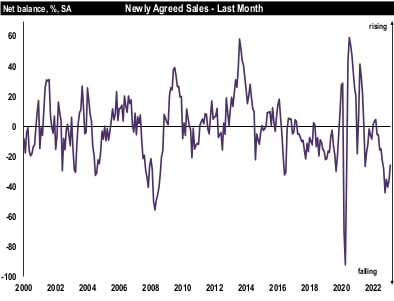

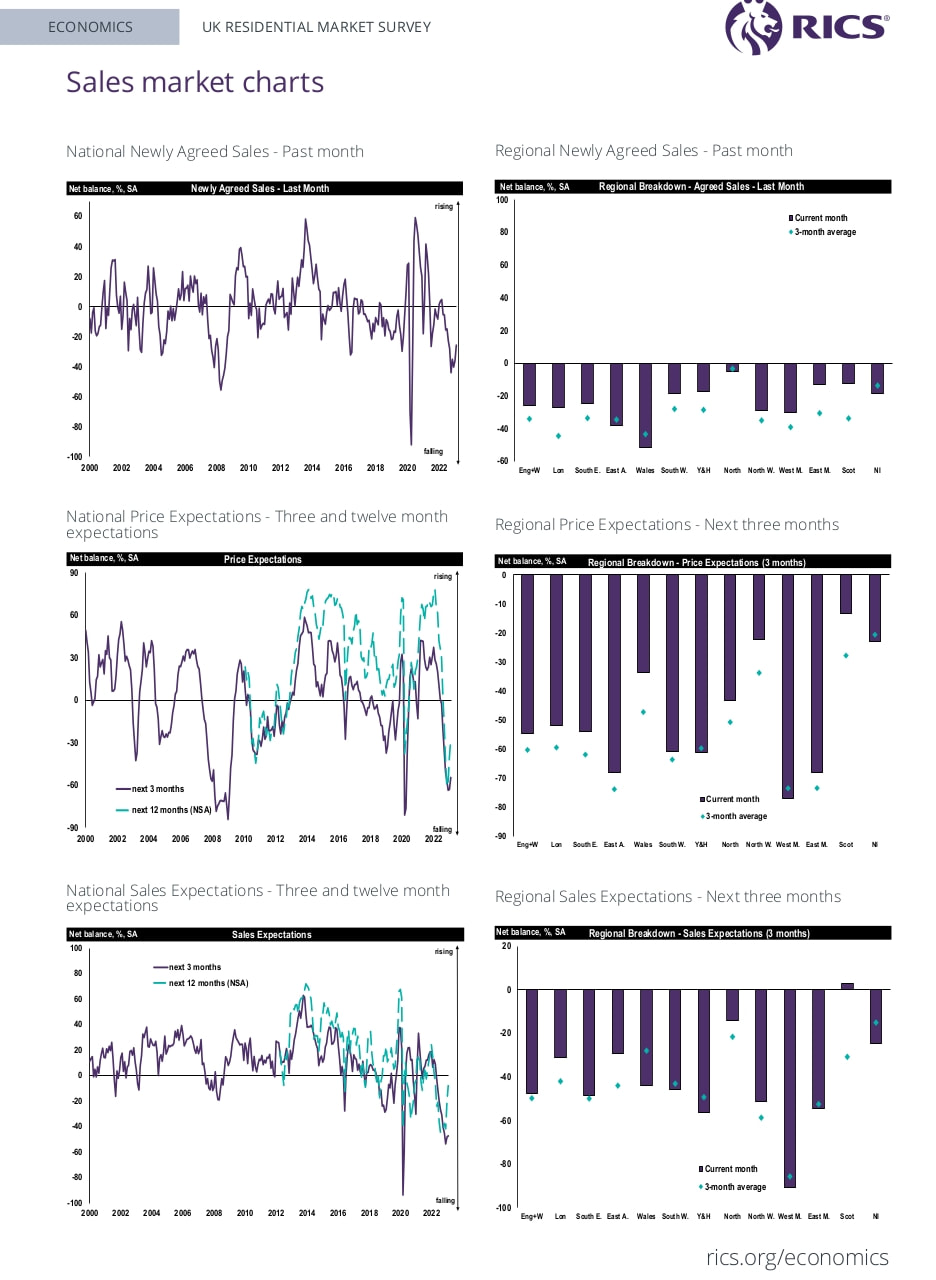

Net borrowing of mortgage debt by individuals decreased from £2.0 billion in January to £0.7 billion in February, the lowest level since July 2021 (£1.8 billion of net repayment). If the period since the onset of the Covid-19 pandemic is excluded, net borrowing of mortgage debt was at the lowest level since April 2016 (also £0.7 billion). Gross lending decreased from £22.9 billion in January to £20.8 billion in February, while gross repayments fell slightly from £21.4 billion to £20.1 billion. Net approvals (that is, net of cancellations) for house purchases, an indicator of future borrowing, increased to 43,500 in February, from 39,600 in January (Chart 1). This was the first monthly increase in approvals for house purchases since August 2022. Approvals for remortgaging (which only capture remortgaging with a different lender) also rose to 28,100 in February from 25,400 in January.Chart 1: Mortgage approvals

Seasonally adjusted

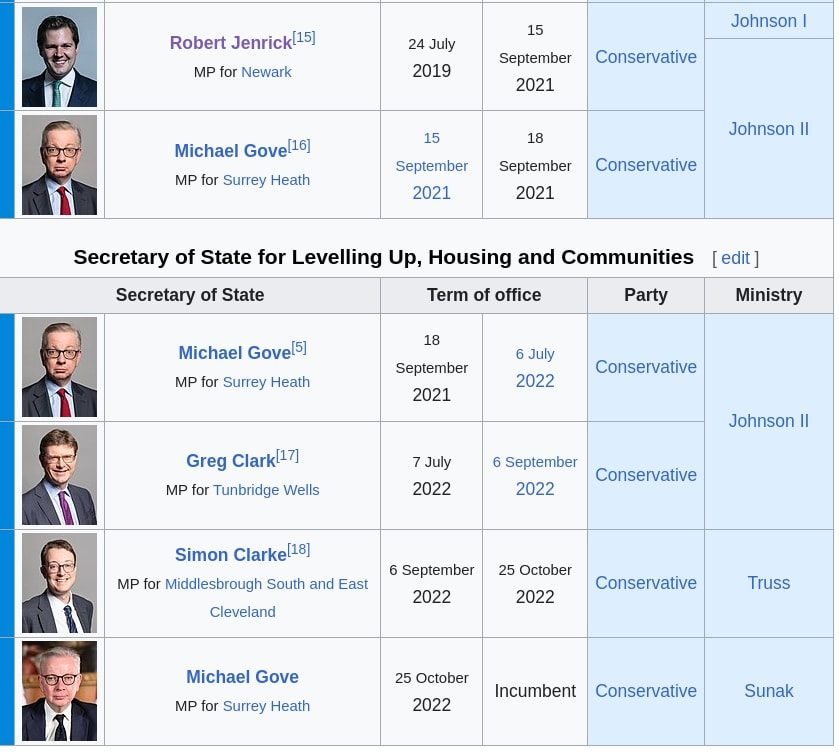

https://twitter.com/richard_donnell/status/1655129170756661248 https://twitter.com/richard_donnell/status/1655137148079677440 https://twitter.com/George_Nixon97/status/1655109483994001412 https://twitter.com/George_Nixon97/status/1655149045222977545 https://twitter.com/RealEstateLand3/status/1655176398758195201 https://twitter.com/RealEstateLand3/status/1655177446520500225 https://twitter.com/DurhamWASP/status/1653892326413008897 https://twitter.com/CunneenKeith/status/1651728338317082624 https://notthegrubstreetjournal.com/2023/01/02/from-homes-for-heroes-to-exponential-zeroes-neglected-actors-in-the-housing-crisis-narrativeabsorptionrate-lasttimebuyerscash-buyers-fiscalpolicy-miras-and-stampduty-an/ https://notthegrubstreetjournal.com/2022/10/01/homeatix-moduloft-the-affordable-housing-manufacturers-defining-the-terms-of-and-boundary-conditions-of-our-domain/ https://notthegrubstreetjournal.com/2022/06/09/benefits-to-bricks-a-homeix-response-to-pm-and-michael-gove-proposing-the-english-scottish-welsh-ulster-land-pound/ https://notthegrubstreetjournal.com/2016/01/06/the-iron-law-of-oligarchy/

https://twitter.com/richard_donnell/status/1655129170756661248 https://twitter.com/richard_donnell/status/1655137148079677440 https://twitter.com/George_Nixon97/status/1655109483994001412 https://twitter.com/George_Nixon97/status/1655149045222977545 https://twitter.com/RealEstateLand3/status/1655176398758195201 https://twitter.com/RealEstateLand3/status/1655177446520500225 https://twitter.com/DurhamWASP/status/1653892326413008897 https://twitter.com/CunneenKeith/status/1651728338317082624 https://notthegrubstreetjournal.com/2023/01/02/from-homes-for-heroes-to-exponential-zeroes-neglected-actors-in-the-housing-crisis-narrativeabsorptionrate-lasttimebuyerscash-buyers-fiscalpolicy-miras-and-stampduty-an/ https://notthegrubstreetjournal.com/2022/10/01/homeatix-moduloft-the-affordable-housing-manufacturers-defining-the-terms-of-and-boundary-conditions-of-our-domain/ https://notthegrubstreetjournal.com/2022/06/09/benefits-to-bricks-a-homeix-response-to-pm-and-michael-gove-proposing-the-english-scottish-welsh-ulster-land-pound/ https://notthegrubstreetjournal.com/2016/01/06/the-iron-law-of-oligarchy/

https://notthegrubstreetjournal.com/2023/03/29/usura-pounding-at-the-open-door-cantos-to-cantons-to-contagion-to-oblivion-usury-hells-fuel-mans-oppressor-bourgeois-resolution-and-globalisation-un-entangled/ https://notthegrubstreetjournal.com/2023/03/27/rate-hikes-have-been-going-too-far-and-too-fast-to-be-explained-by-the-likely-trajectory-of-inflation-in-the-medium-term-baileysbust/ https://builtplace.com/instant-infp-bank-of-england-gross-net-lending/

https://notthegrubstreetjournal.com/2023/03/29/usura-pounding-at-the-open-door-cantos-to-cantons-to-contagion-to-oblivion-usury-hells-fuel-mans-oppressor-bourgeois-resolution-and-globalisation-un-entangled/ https://notthegrubstreetjournal.com/2023/03/27/rate-hikes-have-been-going-too-far-and-too-fast-to-be-explained-by-the-likely-trajectory-of-inflation-in-the-medium-term-baileysbust/ https://builtplace.com/instant-infp-bank-of-england-gross-net-lending/

RSS Feed

RSS Feed